We support knowledge development to help SMEs navigate the Defence sector. This includes industry trends, insights, developments and guides to doing business in Defence.

Orbital objectives: defence answers the call of the cosmos

)

Once the playground of superpowers alone, the space domain is increasingly hospitable for industry, smaller nations and cutting-edge innovations which are being used for more diverse applications. Promising much, the final frontier of human exploration is under a spotlight as defence industries mobilise around efforts to develop satellites, vessels, propulsion systems, energy sources, defences, surveillance systems and more. Defence Engage examines the significance of the space sector to defence, the trends and suppliers which are coming to the fore.

The significance of space as a security domain

Allied governments, NATO and the EU are united in their understanding of space as a critical domain of interest to the defence of their respective and collective security. Investment in space has remained low over recent decades but is now on the up due to a renaissance in industrial, government and military interest driven by a growing dependence on increasingly crowded constellations of satellites.

Modern life is facilitated in large part by technologies which are enabled by space-bound assets. A report by the UK Parliament’s Defence Committee states that ‘space plays an essential role in modern life. Government, business, and the public rely on satellites for services as diverse as smartphones, traffic control, weather forecasting, and banking’.

Space is an arena where strategic competitors are seeking an edge that can secure their future as space powers, as reflected in the security architectures of NATO and individual members’ defence strategies:

‘Strategic competitors and potential adversaries are investing in technologies that could restrict our access and freedom to operate in space, degrade our space capabilities, target our civilian and military infrastructure, impair our defence and harm our security’, NATO’s Strategic Concept 2022.

Space is undoubtedly a domain of great economic and societal opportunity, where innovations can yield impactful solutions to key global problems. Many nations and organisations have developed policies with a view to exploiting the space domain: the EU space policy for example aims to tackle some of the most pressing challenges today, such as fighting climate change, helping to stimulate technological innovation, and providing socio-economic benefits to citizens.

Beyond defending critical national infrastructure, space is critical for military defence. Reliance on satellites demands increasingly sophisticated ways to upgrade and enhance them, as well as innovative ways to deploy assets to space either as part of constellations or individual platforms. NATO is very clear on the critical part space has to play:

‘Space underpins NATO's ability to navigate and track forces, to have robust communications, to detect missile launches and to ensure effective command and control. More than half of active satellites orbiting the Earth belong to NATO members or companies based on their territory. NATO Allies increasingly rely on space for various national security tasks, as well as military operations around the globe. Space data, products and services are a critical enabler and directly support other operational domains.’

Global growth: space is going from strength to strength

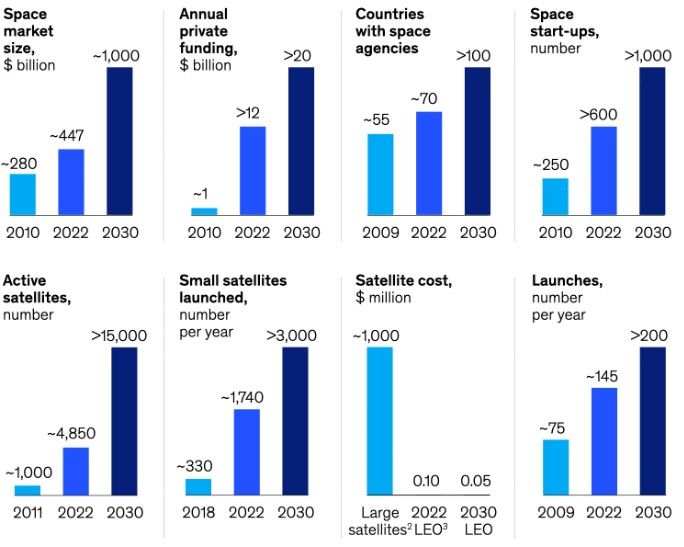

More interest, more access and more participation is being driven by falling prices. With the cost of ‘heavy launches in low-Earth orbit (LEO) falling from $65,000 per kilogram to $1,500 per kilogram (in 2021 dollars) – a greater than 95 percent decrease’. According to McKinsey & Company, ‘the space market, has grown to approximately $447 billion – up from $280 billion in 2010 – and could grow to $1 trillion by 2030’.

Image source: McKinsey & Company (click here for full citations)

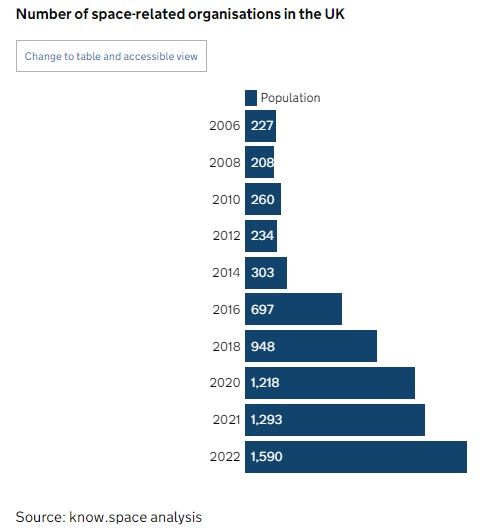

In the UK, space is increasing its contribution to GDP as new spaceports open, more employees join the sector and an increasing numbers of start-ups and SMEs gain access to space. The 2022 report ‘Size & Health of the UK Space Industry’ finds a ‘remarkably robust’ industry, resiliently weathering disrupted operations to return growth in income, employment and Gross Value Added (GVA). Total UK space industry income grew +5.1% in real terms to £17.5 billion in 2020/21 – the second fastest annual growth in the last seven years.’

Image source: Know.Space Analysis/ ‘Size and Health of the UK Space Industry’

Trends in Space

- Planetary defence

Planetary defence refers to the efforts made by scientists and space agencies to protect Earth from potential collisions with asteroids or other near-Earth objects (NEOs). These objects pose a serious threat to life on Earth if they collide with our planet, as they can cause significant damage and destruction, potentially even leading to mass extinctions.

One of the primary strategies for planetary defence is the detection and tracking of NEOs. Many telescopes and observatories around the world are dedicated to this task, monitoring the skies for any objects that could pose a threat. Once an object is detected, its trajectory is carefully calculated to determine the likelihood of a collision with Earth.

Recent developments in the defence of our planet centre primarily around the success of NASA’s DART mission, which saw a change in trajectory achieved by a targeted object. “All of us have a responsibility to protect our home planet. After all, it’s the only one we have,” said NASA Administrator Bill Nelson. “This mission shows that NASA is trying to be ready for whatever the universe throws at us. NASA has proven we are serious as a defender of the planet. This is a watershed moment for planetary defence and all of humanity, demonstrating commitment from NASA's exceptional team and partners from around the world.”

In 2025 China is planning its own version of a planetary defence test, which will be targeted at the roughly ‘30-meter-diameter 2019 VL5 with relative velocity of 6.4 kilometres per second, with the aim of altering the asteroid’s velocity by around five centimetres per second’ according to Space News.

- Cleaning up our atmosphere

Many nations and organisations have been availing themselves of the opportunity to remove space debris from Earth’s orbit. The use of innovative new methods to de-orbit the potentially dangerous remnants of satellites and rockets is essential to the security of satellite infrastructure. The International Space Station is regularly tasked with changing trajectory to avoid impacts from debris, which has been left in orbit. In 2022 the UK awarded contracts to ClearSpace and Astroscale to design missions to remove existing pieces of debris, awarding £4 million as a start since orbital congestion and space debris is one of the biggest challenges facing the global space sector.

Meanwhile NASA has introduced the Active Debris Removal Vehicle (ADRV), an efficient and effective solution to remove large debris from LEO such as spent rocket bodies and non-functional satellites. The ADRV performs rendezvous, approach, and capture of non-cooperative tumbling debris objects, manoeuvring of the mated vehicle, and controlled, targeted reposition or deorbit of the mated vehicle.

Image source: ClearSpace

- Solar farms in space

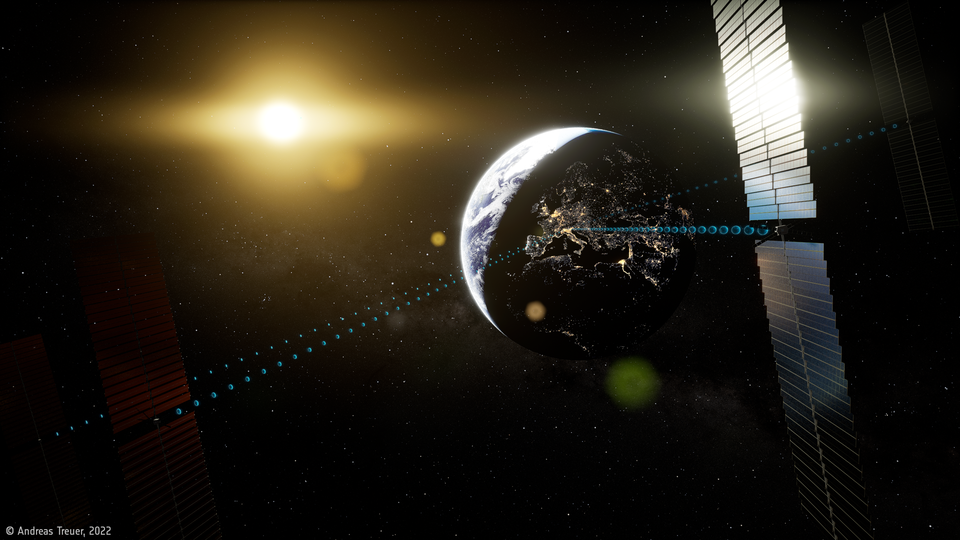

Energy security is high on the agendas of many nations, especially in the wake of Russia’s invasion of Ukraine. New projects hope to provide solutions to both climate crises and energy diversification. Solar farms in space are nothing new but the move towards transmitting the energy back to Earth is a significant development. In September 2022 the European Space Agency proposed feasibility tests for SOLARIS, which side-steps the intermittency of ground-based solar and wind. With this, solar power satellites in geostationary orbit would harvest sunlight on a permanent 24/7 basis then convert it into low-power density microwaves to safely beam down to receiver stations on Earth.

Image source: European Space Agency

- Nuclear power in space

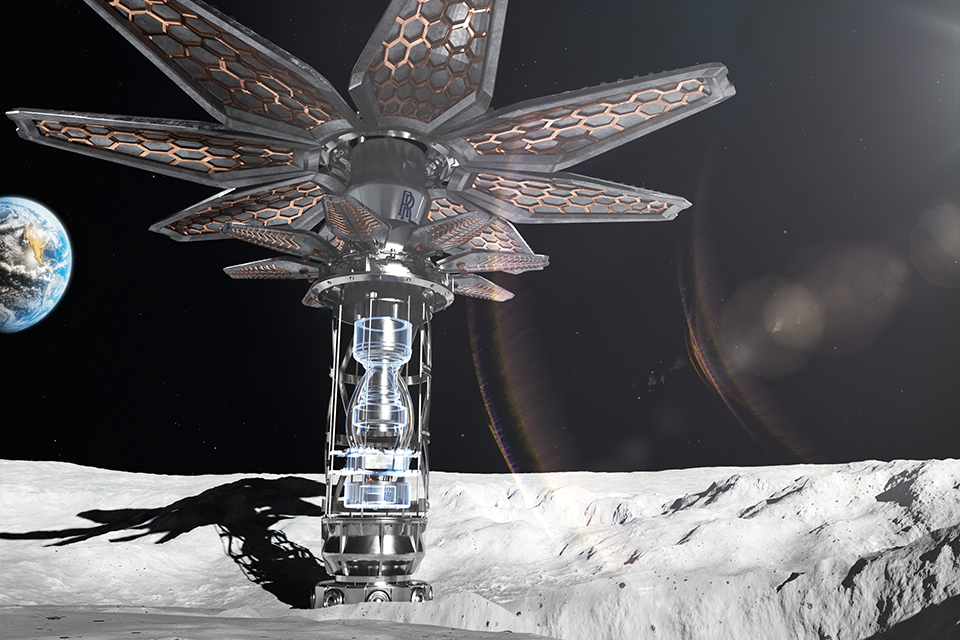

In March 2023, the UK Space Agency backed Rolls-Royce nuclear power for Moon exploration in an impressively ambitious bid to bring small nuclear reactors to space, at a time where the UK’s domestic energy crises demand much greater domestic production.

The potential applications of Rolls-Royce Micro-Reactor technology are wide-ranging and could support commercial and defence use cases in addition to those in space. The aim is to create a world-leading power and propulsion capability for multiple markets and operator needs, alongside a clean, green and long-term power source. Minister of State at the Department of Science, Innovation and Technology, George Freeman commented, “As we prepare to see humans return to the Moon for the first time in more than 50 years, we are backing exciting research like this lunar modular reactor with Rolls-Royce to pioneer new power sources for a lunar base”.

Image source: Rolls Royce

- Spaceports

Ranging from simple launch pads to complex facilities with various buildings, control rooms, and support infrastructure, spaceports can be used to launch a variety of spacecraft, including satellites, crewed spacecraft, and probes. With the development of commercial spaceflights such as Elon Musk's SpaceX and Sir Richard Branson's Virgin Galactic, spaceports are no longer just something being developed by governments but are increasingly becoming more open and commercial sites.

Historically, Kazakhstani sites and Cape Canaveral (US) have been the go-to launch sites, but recently the UK has been positioning itself as the European launch hub with seven sites earmarked to become spaceports.

‘The UK is the most attractive destination in Europe to host commercial launch services. Working with pioneering launch systems and space services, each of our spaceports will provide access to a range of valuable polar and sun-synchronous orbits.’ (A guide to UK spaceports)

Image source: ORBEX

Other emerging areas include:

- In-orbit servicing

- In-space manufacturing

- In-situ space resource utilisation

- Materials for deep space exploration

- Off-world cyber security challenges

Recent collaborations announced

Bilateral and multilateral space projects are increasingly common as nations seek to combine their areas of expertise to produce space solutions faster and more effectively. Whether signing memorandums of understanding, creating joint frameworks or financing projects together, it appears that collaboration is key to unlocking advancements in the space domain.

Japan – UK (17/03/2023) UK and Japan sign arrangement to cooperate in space

ESA – Mexico (15/02/2023) European Space Agency signs Cooperation Agreement with Mexico

NATO – Allies (15/02/2023) 16 Allies, Finland and Sweden launch largest space project in NATO history

Italy – UK (09/02/2023) UK and Italy agree to deepen cooperation in space and cyber domains

Israel – USA (02/02/2023) NASA & Israel Space Agency to cooperate on Beresheet 2 lunar mission

USA – India (31/01/2023) US & India Space Joint Working Group advances space collaboration

Egypt – AU (28/01/2023) Egypt, AU sign agreement to establish the HQ of African Space Agency

US – Japan (15/01/2023) United States and Japan sign space cooperation framework agreement

Suppliers to watch in space

.png)

Alongside defence Prime contractors, the space sector also sees consumer brands such as SpaceX, fronting rocket technology for commercial and government use alongside its Starlink constellations which have proved invaluable to the Ukrainian war effort, and Relativity Space which produced the world’s first 3D printed rocket. However, the sector is not without risks as seen with Virgin Orbit, which was pioneering UK-based satellite deployments, yet filed for bankruptcy in April after its first domestic launch attempt.

Space has become increasingly accessible, offering fertile ground for innovative SMEs to operate such as Defence Engage members:

.png)

STAR-Dundee focus on spacecraft on-board data-handling and processing technology.

AAC Clyde Space specialists in small satellite technologies and services that enable businesses, governments and educational organisations to access high-quality, timely data from space.

RINA support clients through their entire project life-cycle, providing independent and confidential advice.

Oxford Space Systems offer a portfolio of antennas aimed at improving performance, maximising stowage efficiency and minimising mass.

3D Perception provide seamless, immersive simulation visual display systems for land, air, sea, and space applications.

Summary

Due to the increasing reliance on space-based assets, there has been a resurgence of interest and investment in the space domain. The acknowledgement of space as an indispensable aspect of modern life is reflected in the defence strategies of NATO and its individual members, while growth is expected in areas such as maintenance, harvesting power, new launches and in-orbit developments to help the next leap forward into space. As a new competitive frontier for governments and private industry, falling costs and increasing investment bode well for innovation and progression in the space domain which has potential to reach a value of $1 trillion by 2030.

Useful links:

.png)

Canada: Canadian Space Agency

Europe: European Space Agency (ESA)

France: Centre National D’Etudes Spatiales (CNES)

Italy: L'Agenzia Spaziale Italiana (ASI)

Japan: Japan Aerospace Exploration Agency (JAXA)

United Kingdom: UK Space Agency and UK Space Command

USA: National Aeronautics and Space Administration (NASA) and Space Force

DISCOVER DEFENCE ENGAGE APPLY FOR A PROFILE DEFENCE CONTRACT DIGEST FOLLOW US ON LINKEDIN